Are you adding value as an internal auditor or you are just ticking and bashing and getting lost in the paperwork? In these pandemic times, you must claim your place at the highest table of decision making by providing consulting and advisory insights that transform your audit clients.

To read the complete presentation we made to the Government of Uganda Internal auditors, under the auspices of the Internal Auditor General, Transform-your-internal-Audit-Department

Internal auditors have a place at the highest level of decision making – the audit committee of the board as they report directly to the board (functionally – internal audit mandate and audit strategy, plan and execution) and report to the chief executive officer for administrative roles (internal facilitations to meet department heads to fulfill the audit plan, etc).

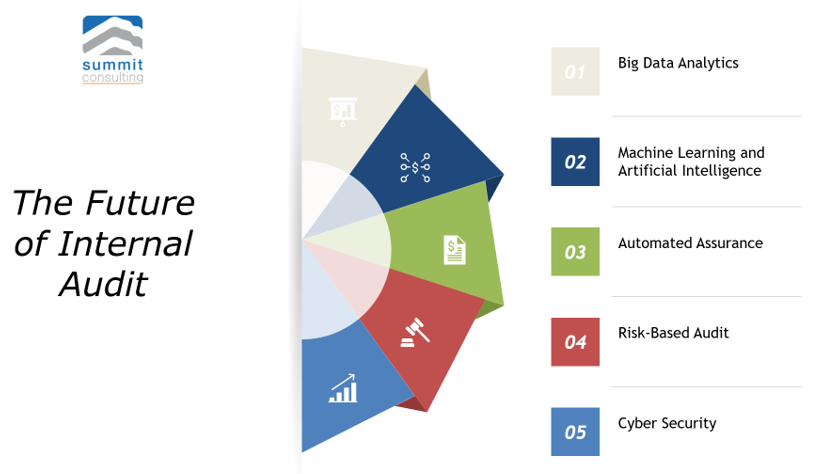

The future of internal audit shall entail the following skills:

Big Data Analytics

Leveraging from data-driven insights to unearth what is hidden in your data, detect anomalies, and significant patterns. Do your internal audit team possess skills and tools to analyze and examine big data sets for anomalies and red flags? Are you scared with large data sets or you know what to do?

Now is the time to learn data science, data analytics, and visualization. That way you gain capabilities to add value to the business. With data analytics, Internal Audit is not only able to identify fraud red flags but can provide insights to help with strategy and business optimization. Imagine an internal audit providing insights to the top management of the branch that is not breaking -even or the minimum number of transactions via a specific channel to break-even.

Data is always evolving and so must internal auditors.

1. Machine Learning and Artificial Intelligence

Internal audit groups have embraced the internal audit trend of advancing toward robotic process automation (RPA) and cognitive intelligence (CI) tools (collectively RPA&CI) to drive efficiency, expand capacity, boost quality, and extend audit coverage.

These tools are not light miles ahead. They are with us today. How do you leverage them to add value in whatever you do? What machine learning algorithms are you embracing to improving your work? Now is time to hire young programmers in internal audit departments and optimize the use of programming tools like python and leverage from the machine learning and artificial intelligence. The times of just asking for an audit log file or printout of the user matrix are long gone.

You must have the internal skills to do these tasks on your own to truly provide independent assurance and consulting to the organization to improve governance and risk management.

2. Automated Assurance

Automation leads to higher levels of assurance as larger populations of transactions can be tested and controls can be continuously audited. Automated assurance also enables the movement of assurance-related activities to the second line—to compliance, cybersecurity, risk management, and similar functions—or to the first line, where the risks should be managed and where people can act on the results.

How has your internal audit invested in capabilities to offer automated assurance? How do you get real-time notifications from critical databases and data tables to provide proactive assurance of risk management instead of being informed after the fact? The future is about prevention instead of cure. And an internal audit of the future must be proactive to invest in tools and technologies that anticipate risks and prevent them instead of responding after the risk has materialized.

The advantage of automated assurance is it prevents the risk of pre-auditing that tends to remove internal audit independence. It promotes real-time independent monitoring and assurance in the protection of shareholder value. That is the future of the profession. Are you ready?

3. Risk-Based Audit

Continuous risk monitoring, assessment, and tracking can help internal audit direct its resources to where they’re most needed—a valuable departure from rotational audit plans. This approach can change the dynamic with stakeholders, enabling internal audit to more effectively anticipate risks and advise management. Functions ahead of the curve on this internal audit trend are moving toward real-time risk monitoring via technology-enabled risk sensing, analytics, and visualization tools

4. Cyber Security

As the strategic importance, risks, and opportunities of cyber increases, internal audit needs to adapt if it is to continue to provide value to the organization. This entails a shift from IT and compliance-based approaches to a more risk-based approach to cyber. In this internal audit trend, most internal audit groups find covering all cyber issues challenging, mainly due to a lack of resources and depth of skills.

At Summit Consulting Ltd, www.summitcl.com, we provide internal audit training and support in data analytics, forensics, and cybersecurity assurance to empower your team to win. If you don’t have a huge budget, we help provide you with the tools to do the work at the cheapest cost, while delivering world-class assurance.

To read the complete presentation we made to the Government of Uganda Internal auditors, under the auspices of the Internal Auditor General, Transform-your-internal-Audit-Department

To call us for help with data analytics, cybersecurity, and risk management, CONTACT HERE. Feel free to invite us to speak to your team via Zoom of the future of internal audit and the skills required to win. The talk shall be free of charge, depending on the availability of slots and time on our part. First come, first served.

Copyright Mustapha B Mugisa, 2020. All rights reserved.